Posts

The newest implementation of blockchain technical you are going to enhance the shelter and you may visibility of cellular purchases. Simultaneously, the brand new prevalent use of biometric tests get next bolster security features. You could potentially help alleviate problems with con because of the contacting the lending company who’s indexed because the a’s issuer to verify the brand new take a look at’s credibility. Simultaneously, be suspicious out of not familiar somebody providing to send you money. But We’ve recognized individuals destroy a too early, simply to discover an email two times afterwards asking her or him to take the fresh check up on a part on account of a mobile put error. If you put your own view out of your mobile phone, your wear’t have to make a new visit to the financial institution.

Cellular test put provides revolutionised how we deal with dumps, promoting a fast and easy financial revel. Incorporate the effectiveness of cellular look at put and you can clear up the banking enjoy today. Cellular deposit setting users can also be deposit monitors 24/7 and steer clear of vacation to a physical lender or borrowing union part. Money from cellular view deposits are typically available the very next day, than the four working days to have a paper take a look at. Pay by Cellular casinos are believed secure with the play with away from safe mobile billing steps.

Take on Money

In the last 6 ages, he’s got shared their academic training on the increase of contemporary payment tips, establishing themselves because the all of our commission actions pro. Make sure to check your selected gambling establishment caters the fresh money one to you wish to have fun with beforehand to quit disappointment and you will fury. BT is the only United kingdom operator to let repayments from the landline, catering to customers which is generally out of an adult age group and you will less likely to want to individual a cell phone. It’s as well as a terrific selection for professionals who misplace the mobiles however, don’t need to overlook trying to their luck online. Speak to your provider to have details of certain charge and fees.

For individuals who’re using the Financing One Mobile software, before you could upload a photograph of your take a look at, the newest application often alert you to any relevant restrictions. If you need to deposit an amount that’s over the new restrict, visit one of our branches or ATMs. Most banking institutions do not let cellular deposits away from 3rd-team checks, even if he is signed off to you. These checks usually need to be placed in the a part that have proper character. Should your financial also provides cellular consider deposit and you haven’t used it yet ,, open the fresh software the very next time you will get a.

Try to bring your membership back to a confident harmony gamblerzone.ca useful content before making in initial deposit. In such a case, their deposit count is higher than the brand new daily restriction from the $five hundred. You would have to sometimes hold back until the very next day so you can deposit the fresh view otherwise get hold of your financial to help you demand a higher limitation. Mobile money is a relatively secure percentage means one to an incredible number of people around the world fool around with each day, and you have nothing to worry if you try transacting that have a professional broker. Definitely favor a trustworthy and you may reputable agent because of the checking our directories of the best change networks one to undertake mobile currency dumps. Sign up with a broker that has reduced exchange charges to enable you to get by far the most worth from every cellular deposit.

Because the reduced everyday restrict you’ll become limiting to have big spenders, informal professionals who’re seeking control its bankroll will find this one primary. At the NewCasinos, we’re invested in getting unbiased and sincere reviews. Our loyal benefits very carefully run within the-depth research for each web site when comparing to be sure we have been purpose and you may full. Our very own reviews is assigned following the a detailed score system considering rigid conditions, factoring within the certification, games alternatives, fee procedures, safety and security steps, or other issues. Several prepaid credit card issuers render cellular deposits, that allow you to definitely play with an android or ios application to help you put a on the prepaid card.

So you can get photos of your consider, extremely cellular financial software show you which have an overview of your own check up on their display screen. The brand new application also can make the pictures for you when you’ve centered the new check in your own equipment’s cam viewfinder or allow you to take the photographs. You’ll want to do it for both the back and front of one’s look at. You might deposit very sort of inspections right into your own checking account otherwise savings account having fun with Wells Fargo mobile deposit. Qualified view types were personal, company and most government inspections. Take a look at Deposits of greater than $ten,100000 Once again, depending on the financial, you will possibly not be permitted to deposit their $ten,100 view thru cellular put in your cellular telephone, otherwise from the an automatic teller machine.

- Mobile look at put are a financial element in which consumers capture a photograph of a check in their organization’s cellular banking software and submit they about.

- Even though mobile consider dumps is smoother, particular banking institutions fees fees to own specific features.

- For example, lay a white check into a dark-coloured dining table before you take the fresh pictures.

- Community Checking accounts that are more 3 months old can also be put up to $twenty five,000 thru a mobile.

- You’ll also find it on the listing of recent transactions in a single working day.

Our standard rules should be to will let you withdraw currency deposited on your own account zero after versus next business day just after the day i confirm the brand new acknowledgment of your deposit. Pursue now offers some of the best family savings incentives on the market, however, that it lender and lets you put up to $dos,100 a day or $5,000 per month after you create mobile deposits. Easily put inspections in to the eligible HSBC checking otherwise deals account utilizing the camera on your new iphone 4, iPad, or Android™ equipment and also the HSBC Cellular Banking application@appinfo. Your financial establishment and its particular mobile financial app have unique guidelines and requirements, so be sure to opinion the necessary steps to deposit an excellent register the app. The lender otherwise standard bank will ask you to term your own view because the a cellular take a look at deposit under your signature.

Get acquainted with your own bank’s cellular software functionalities. Typical play with will allow you to be much more comfortable with the method and you may increase banking feel. Specific banking companies demand constraints on the amount you can deposit thanks to cellular consider put.

But not, the best banking institutions to own cellular banking make their application a focus of their solution and then try to create using it incredibly affiliate-friendly. Mobile Take a look at Put makes you bring a graphic of your front and back of the supported check with the brand new mobile app as well as your device’s digital camera. Just find the account you need the new look at deposited on the and enter the level of the fresh look at. Then you certainly complete the transaction to HSBC from the cellular application and we’ll processes the fresh view.

What’s a cellular look at put? Here’s what you need to understand

Merely get your salary from your employer, unlock the brand new app at the table and put your register lower than a couple minutes. Users who have a qualified HSBC savings or bank account. You really must be inserted for personal Websites Banking and also have downloaded a recently available kind of the fresh HSBC Cellular Banking App.

Other Find Issues

Mobile consider deposit is actually an option section of today’s electronic financial landscaping and you can an incredibly popular element of one’s applications that are transforming customers’ on the web financial feel. This technology provides a far more simpler, successful, and you can safer way of getting checks to your membership, helping each other banking people as well as their organizations. To begin, install the newest Seacoast Mobile Banking app1 and you will login with your on line banking account. Mobile take a look at deposit is secure, using encoding to ensure the protection from deals.

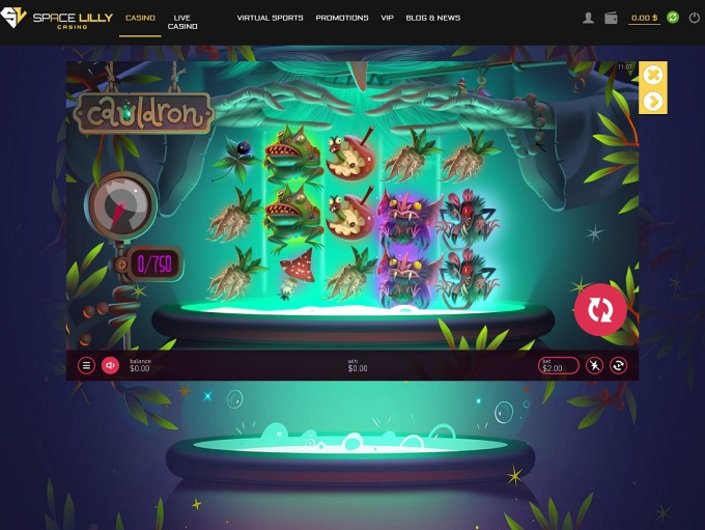

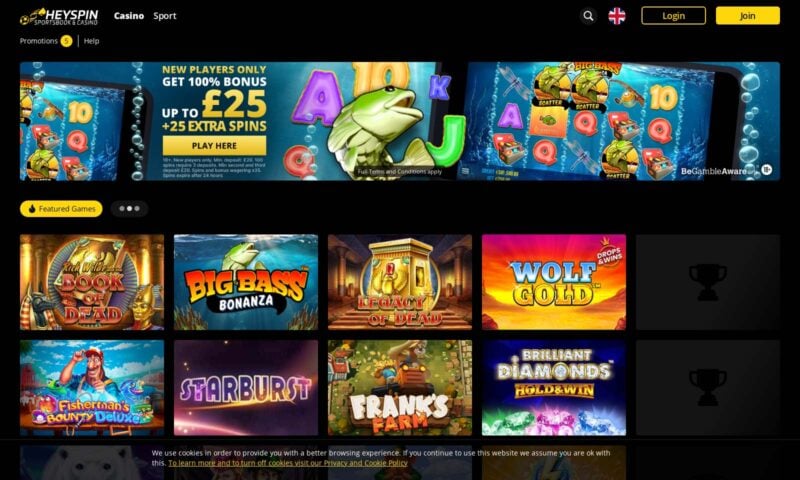

Most other business for example Yards-Pesa charge a speed for each exchange, to the number you pay scaling to your sized the new deposit. Yet not, the money is almost certainly not available for a couple of hours in order to a few days, according to the merchant’s rules. There, you can go to the ‘Payment Method’ filter out and choose your vendor. You ought to following discover all the gambling enterprises that provide incentives and you can believe that strategy. To see the brand new pay-by-mobile phone sites with enacted the rigorous analysis having traveling tone, up coming buy the ‘Recommended’ filter out. These are probably to treat their clients really and provide a good number of video game, causing them to an educated wager to have a positive gambling feel.

Banking institutions have varying daily, per week, and month-to-month limits to the cellular view deposits, so look at the financial arrangement. For those who arrived at a cellular take a look at deposit restriction, you happen to be able to deposit a lot more inspections in person. A cellular view deposit takes one complete working day so you can processes. If you’d like their money available instantly, particular creditors usually process your own take a look at instantly however, want you to pay a charge. That it fee can be a small % of your view, as much as 1% in order to 4%. Discover’s Cellular Consider Deposit is fast – snap photographs of the closed take a look at and you may publish him or her in minutes in order to deposit them with the cellular app.

Comentarios recientes